AmeriFirst Banking Services

Overdraft Protection

AmeriFirst offers a plan to end checking account overdraft complications and charges. Overdraft protection means that we’ve approved, in advance, a personal loan to balance your account should you become overdrawn. With this plan, you can avoid costly overdraft charges and embarrassing delays.

We’ll be glad to talk with you about how to apply, access to your overdraft line, finance charges, payment schedules and your credit loan limit.

**Equal Housing Lender. Certain restrictions may apply. All loans are subject to approval.

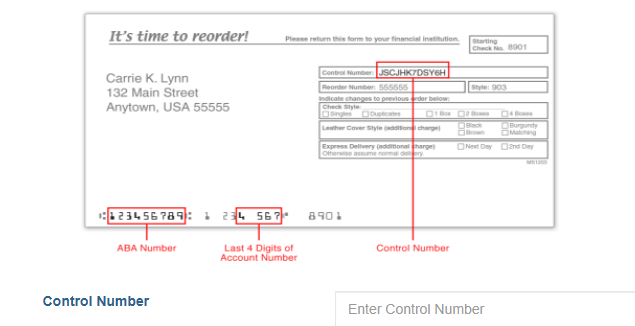

Reorder Checks

Checks reordered through MAIN STREET CHECKS will:

- Be able to change the check style.

- Be able to change the starting check number.

- Be able to select singles/duplicates style checks.

- Be able to select shipment method.

- Have the exact name and address as your last check order.

- Be delivered to the last mailing address as your last order (with the exception of special alternate mailing orders).

- Have your reorder form ready to enter the requested information from the form

o ABA Routing Number

o Account Number

o Control Number

Click here to reorder checks.

Click here to reorder checks.

Direct Deposit

Why Direct Deposit?

- Because direct deposit is better than checks

- Safe: no more lost or stolen checks

- Convenient: your benefit is in the bank even when you are out of town, sick, or can’t get to the bank

- Reliable: for more than twenty years, beneficiaries have used direct deposit

- Dependable: payment is available at opening of business on your payment date

Consider the differences and make the right choice – DIRECT DEPOSIT.

It’s easy to sign up. Call or come by one of our three locations and ask for details.

Let us help by calling 1.800.298.1763 or visiting one of our five locations.

Cashier’s Checks

Cashier’s Checks are available at all AmeriFirst Bank locations to customers only.

Fee to purchase a cashier’s check: $10.00

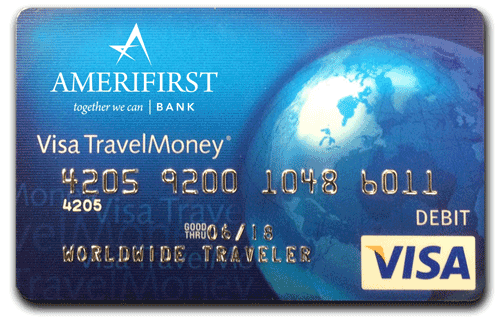

Travel Cards*

Travel Smart!!!! Get a Visa TravelMoney card today.

- $9.50 fee to purchase a reloadable chip travel card

- The card that goes almost anywhere

- Easier to use than travelers cheques

- Safer than cash

- Smart and easy way to manage your money when you travel

- $2 Reload fee

The Visa TravelMoney card is a prepaid Visa card. Spending is limited to the amount of money you load. Each time you make a purchase, the amount is automatically deducted from the balance.

Come by any location to get your Visa TravelMoney card.

*Available to AmeriFirst Bank Customers ONLY. Specific terms, conditions, and exclusions may apply.

Gift Cards*

Perfect gift for all occasions! Give the gift of choice with a Visa gift card.

- $5.00 fee to purchase for customer

- Available in any dollar amount from $10 up to $1,000

- Use anywhere Visa debit is accepted

- The perfect gift for any occasion

- Easy online access to view card information

- Replaceable if lost or stolen

See a personal banker for complete terms and conditions

*Available to AmeriFirst Bank Customers, ONLY.

ACH Origination Payments

ACH payments are among the fastest growing services provided by the banking industry. For businesses, payments are received reliably and timely. For consumers, pay is deposited when expected and withdrawals are made as agreed.

The Automated Clearing House (ACH) is the electronic payment network used by individuals, businesses, financial institutions and government entities. The ACH network exchanges funds and information throughout the fifty states and US territories and has recently expanded the network to reach across US borders to Canada. About 98% of the nation’s financial institutions, including thousands of credit unions, participate in the ACH network. The ACH vastly improves cash management capabilities and reduces the cost of funds.

The ACH network allows the transfer of either credits or debits to checking accounts, savings accounts and financial institutions.

There are few costs associated with this service.

** Certain other fees and restrictions may apply. Please click here to be taken to a list of the Bank’s Service Fees.

Automatic Transfer

Automatically Transfer Payments between accounts—checking to savings, savings to checking, etc….

AmeriFirst offers you the convenience of setting up certain transfers on an automatic transfer. These transfers are available at various options (daily, monthly, weekly, etc.). Transfers can be made between checking/checking, checking/savings, checking/loans, or checking/Christmas Club. Once authorized and set up for your accounts, the transfers are made timely and reliably.